US Funding Insights: Emerging Strength in AI and Concentrated Hubs

- August 20, 2025

- Posted by: spiceroute

- Category: U.S. Funding & Investment Trends

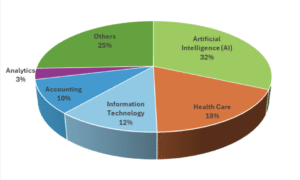

This week, 71 US startups collectively raised approximately $938 million in equity funding. The data highlights a steady and resilient venture capital ecosystem. Artificial Intelligence (AI) remained the dominant sector, securing nearly $297 million across 18 companies. Other significant sectors drawing substantial investment include Health Care ($168 million), Information Technology ($110 million), and Accounting ($92 million).

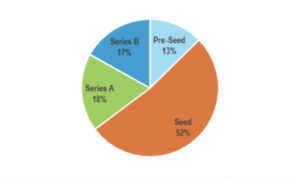

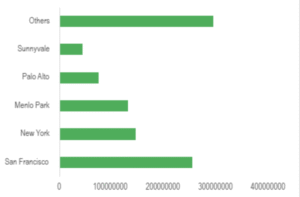

In terms of funding stages, Series B rounds topped capital raised with $503 million across 12 deals, followed by Series A at $291 million (13 deals). Seed rounds raised $138 million in 37 deals, and Pre-Seed rounds totaled about $6.6 million across 9 deals. Geographically, San Francisco led with $253 million across 8 startups, followed by New York with $145 million (11 companies), Menlo Park ($130 million, 3 startups), and Palo Alto ($74 million, 3 startups).

The market outlook indicates measured confidence in startup growth and exits, with active funding spanning various stages and sectors.

Top Industries of the Week:

Artificial Intelligence (AI): $297 million (18 companies)

AI continues to attract robust investor interest, driven by innovations in machine learning, natural language processing, and applied AI technologies across multiple industries. Major deals include Decart’s $100 million Series B in San Francisco, Chai Discovery’s $70 million Series A, and Lyric’s $44 million Series B in Sunnyvale, illustrating strong growth at various funding stages.

Health Care: $168 million (4 companies)

The health care sector remains a key focus with significant Series B funding such as Apreo Health’s $130 million round in Menlo Park and August Health’s $29 million in San Francisco. This reflects ongoing investor belief in biotech, digital health, and medical innovation.

Information Technology: $110 million (8 companies)

IT startups raised considerable capital with a focus on scalable software solutions and enterprise tools. Notable deals include Stavtar Solutions’ $55 million Series A in New York and ketteQ’s $20 million Series B in Atlanta.

Accounting: $92 million (3 companies)

Accounting and fintech-related startups like Rillet’s $70 million Series B round in Palo Alto highlight growing interest in financial technology and automation sectors.

Additional sectors include Analytics ($30 million), CRM ($30 million), and Finance ($25 million), showcasing a diversified funding landscape supporting foundational and growth-stage companies.

Funding Stage Analysis:

Series B: $503 million (12 deals)

Series B rounds led funding this week, marked by large, later-stage deals that show increased investor confidence in proven business models. High-profile rounds include Apreo Health ($130 million), Decart ($100 million), and Rillet ($70 million).

Series A: $291 million (13 deals)

Series A rounds demonstrated strong capital deployment, reflecting sustained growth and market traction, including Chai Discovery ($70 million) and Stavtar Solutions ($55 million).

Seed: $138 million (37 deals)

Seed funding remains essential in fueling early innovation and startup formation. The high number of deals signals robustness in early-stage venture activity.

Pre-Seed: $6.6 million (9 deals)

Pre-Seed investments continue to nurture nascent ideas and founders, laying the groundwork for future funding rounds.

Outliers: Top Funded Startups

| Rank | Company | Sector | Funding | Stage | Location |

| 1 | Apreo Health | Health Care | $130 million | Series B | Menlo Park |

| 2 | Decart | Artificial Intelligence (AI) | $100 million | Series B | San Francisco |

| 3 | Rillet | Accounting | $70 million | Series B | Palo Alto |

| 4 | Chai Discovery | Artificial Intelligence (AI) | $70 million | Series A | San Francisco |

| 5 | Stavtar Solutions | Information Technology | $55 million | Series A | New York |

| 6 | Lyric | Artificial Intelligence (AI) | $44 million | Series B | Sunnyvale |

| 7 | Pantomath | Analytics | $30 million | Series B | Cincinnati |

| 8 | Kustomer | CRM | $30 million | Series B | Short Hills |

| 9 | August Health | Health Care | $29 million | Series B | San Francisco |

| 10 | Casap | Finance | $25 million | Series A | New York |

Geographic Highlights:

San Francisco led funding with $253 million invested across 8 startups, reaffirming its innovation hub status. New York followed with $145 million across 11 companies, Menlo Park raised $130 million (3 companies), and Palo Alto attracted $74 million through 3 startups. Additional active regions include Sunnyvale ($43.5 million), Cincinnati ($30 million), Atlanta ($30 million), and San Jose ($30 million).

Key Takeaways:

- Hub Concentration: San Francisco, New York, Menlo Park, and Palo Alto continue to command the majority of venture capital flow, underscoring centralized innovation ecosystems.

- Sector Focus: Artificial Intelligence leads closely, supported by strong Health Care and Information Technology investments.

- Stage Distribution: The dominance of Series B funding underscores maturity within the startup ecosystem, balanced by solid Series A and active Seed rounds sustaining growth at different stages.

- Geographic Reach: While major hubs attract most capital, investment in cities like Sunnyvale, Cincinnati, and Atlanta reflects a gradually broadening geographic footprint.

Final Thoughts:

This week’s funding activity among 71 startups totaling $938 million highlights ongoing investor confidence in transformative technologies, particularly in AI and Health Care sectors. The concentration of capital in established innovation hubs like San Francisco and New York continues, alongside meaningful contributions from emerging ecosystems. Balanced stage distribution signals a healthy pipeline geared for sustained growth and exits, painting an optimistic outlook for the US venture ecosystem in the coming months.