US Funding Insights: AI and Biotech Lead $1.25B Equity Surge with Expanding Geographic Reach

- August 20, 2025

- Posted by: spiceroute

- Category: U.S. Funding & Investment Trends

This week, 84 US startups raised over $1.25 billion across 84 deals, highlighting sustained investor confidence amid an evolving venture landscape. The infusion notably aligns with broader North American venture activity, which continues to rebound strongly in 2025 fueled by rapid innovation cycles and a wave of AI-driven enthusiasm. The capital allocation demonstrates the market’s dual appetite for large-scale growth rounds alongside a vibrant early-stage pipeline fostering emerging technologies.

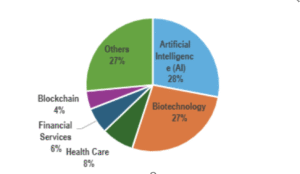

Investor enthusiasm remains heightened for deep-tech sectors, primarily Artificial Intelligence (AI), which once again commanded a crucial share of funding. Complementing this is a renewed surge in Biotechnology investments, coupled with persistent activity in Health Tech, Financial Services, and Blockchain-related ventures. These patterns affirm the US market’s position as a fertile ground for pioneering tech breakthroughs and scalable health and enterprise solutions.

Top Industries of the Week:

Artificial Intelligence (AI) ($349.2M)

AI continues to be the unequivocal leader, raising $349.2 million across 25 deals, reflecting relentless investor focus on the sector’s transformative potential. Funding spanned enterprise SaaS platforms, generative AI, compliance automation, and industry-specific AI applications illustrating the breadth of opportunity. Leading rounds such as Reka AI’s $110 million Series B and Slingshot AI’s $53 million Series A reinforce deep conviction in both foundational and vertical AI technologies. This sustained activity underscores AI’s strategic role in reshaping multiple industries and commanding investor interest globally.

Biotechnology ($338M)

Biotech demonstrated exceptional funding momentum with $338 million across just four deals, propelled by outsize investments including Dispatch Bio’s $216 million Series A and Nudge’s $100 million raise. This marks a distinct comeback in investor appetite for therapeutic platforms and innovative health technologies. These blockbuster rounds signal confidence in biotech’s clinical pipelines and its critical position in addressing unmet medical needs, anchoring a resurgence after a relatively quiet prior period.

Health Care ($97.9M)

The Health Care space raised $97.9 million in six deals, driven by companies developing digital health solutions, advanced medical devices, and patient care technologies. Firms such as Charta Health and Fortuna Health exemplify the ongoing integration of tech-driven models aimed at broader care delivery and access expansion. Stable funding here reflects ongoing investor commitment to scalable business models addressing healthcare efficiencies and consumer engagement.

Financial Services ($78M)

Three deals contributed $78 million to the financial services segment, showcasing steady growth in fintech and insurtech verticals. Startups like Cover Whale and april have attracted investment focused on B2B insurance platforms and digital financial transactions. This continued capital flow reflects the maturation of financial technology sectors, where investor interest is keenly aligned to platforms demonstrating clear customer traction and compliance robustness.

Blockchain & Others ($389.9M)

The remaining $389.9 million was distributed over 46 deals, spanning blockchain infrastructure, electronics, logistics, and enterprise software. Despite fewer transactions, blockchain ventures such as Courtyard and Bitzero Blockchain secured significant funding focusing on NFT infrastructure and sustainable data centers, highlighting strategic bets on digital asset ecosystems. These diversified investments emphasize the expanding breadth of the US innovation ecosystem beyond headline sectors.

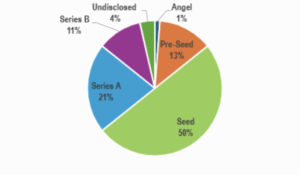

Funding Stage Analysis:

Series B ($344.9M)

Series B rounds represented strong growth-stage funding with $344.9 million raised across nine deals. This stage continues to attract investors backing startups that have demonstrated product-market fit and are scaling operations aggressively. Key rounds including Reka AI underscore sustained interest in companies primed for accelerated expansion, signaling robust market confidence in ventures poised for commercial scaling.

Series A ($626.8M)

Leading the weekly funding by capital, Series A accounted for $626.8 million over 18 deals. This stage reflects the crucial step for companies validating initial business models, scaling teams, and sharpening product-market engagement. Big rounds in biotech and AI sectors illustrate the readiness of companies to transition from validation to broader market penetration, evidencing a vibrant and maturing pipeline.

Seed ($198.01M)

Seed rounds are the most numerous, with over 40 deals raising $198.01 million collectively. This volume showcases a healthy early-stage environment that continues to fuel innovative startups across AI, biotech, and fintech. Seed funding trends signal ongoing investor willingness to support nascent teams that demonstrate disruptive potential and clear paths to future growth.

Pre-Seed ($15.3M)

At the earliest stage, pre-seed rounds raised $15.3 million across 11 deals, providing essential capital for startups to build MVPs, conduct market validation, and lay groundwork. While check sizes remain modest, the steady volume reflects a fertile ground for invention and idea validation, forging a robust pipeline feeding the ecosystem’s upper stages.

Outliers:

| Rank | Company | Sector | Funding Amount (USD) | Funding Stage | Location |

| 1 | Dispatch Bio | Biotechnology | $216,000,000

|

Series A | Philadelphia |

| 2 | Reka AI | Artificial Intelligence

|

$110,000,000 | Series B | San Francisco

|

| 3 | Nudge | Biotechnology | $100,000,000 | Series A | New York |

| 4 | Slingshot AI | Artificial Intelligence | $53,000,000 | Series A | Sunnyvale |

| 5 | Cover Whale | Financial Services | $37,000,000 | Series B | Dallas |

| 6 | Bitzero Blockchain | Blockchain & Infrastructure | $30,000,000 | Seed | Austin |

| 7 | Charta Health | Health Care | $28,000,000 | Seed | Boston |

| 8 | Fortuna Health | Health Care | $23,000,000 | Series A | San Diego |

| 9 | Courtyard | Blockchain | $25,000,000 | Series A | New York |

| 10 | april | Financial Services | $20,000,000 | Seed | Little Rock |

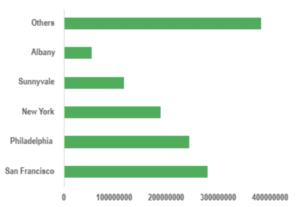

Notable Deals and Geographic Highlights:

San Francisco continued its perennial dominance as the US startup funding hub, raising a commanding $276 million spread over 13 companies, particularly concentrated in AI and fintech. Philadelphia saw a significant boost with $240 million largely driven by large biotech Series A transactions, while New York remained a key player with $186 million across enterprise tech and blockchain startups. Additional cities like Sunnyvale, Albany, and Dallas also reported multi-million-dollar rounds, reflecting a slow but steady broadening in geographic funding diversity. Despite the concentration of capital in a few metro areas, the growing footprint in emerging hubs is an encouraging signal for the future of the ecosystem.

Investor Awareness:

Investors remain laser-focused on startups with well-defined scale strategies and robust technology moats across the growth spectrum. The dual emphasis on AI and biotech reflects confidence in sectors with large, addressable markets and opportunities for technology-driven disruptions. Meanwhile, the sustained flow of early-stage capital into seed and pre-seed funding illustrates continued optimism for the next generation of breakthrough enterprises. Awareness of shifting macroeconomic conditions and exit markets is leading investors to be selective, favoring startups with traction, defensibility, and clear liquidity pathways. Founders should align their fundraising narratives to highlight scale potential, market validation, and technical differentiation to capture this shifting investor mindset.

Key Takeaways:

- AI and Biotech dominate funding, reflecting prevailing investor priorities anchored on breakthrough technologies and growing sector confidence.

- Growth-stage rounds (Series A and B) capture the lion’s share of capital, but a strong seed and pre-seed volume signals a healthy ecosystem pipeline.

- Geographic concentration remains centered on San Francisco, Philadelphia, and New York, though emerging hubs are gaining traction.

- Investor focus is increasingly discerning, emphasizing clear market fit, traction, and scalability across sectors.

- Founders must leverage local networks and highlight differentiated tech and business models to navigate the competitive funding environment successfully.

Final Thoughts:

The US startup ecosystem’s latest funding cycle paints a picture of resilience and maturation buoyed by AI’s enduring momentum and biotech’s vibrant comeback. The combination of large growth rounds and active early-stage investing fuels optimism for sustained innovation leadership. As venture capital markets adapt to evolving economic signals, startups that can clearly demonstrate scalability, defensibility, and market readiness will continue to be rewarded. The expanding geographic dispersion of capital, while still concentrated, suggests a slowly diversifying ecosystem poised for broad-based growth.